CoP11 and GB Electricity Markets

Overview

To meet the UK’s Net Zero ambition, regulations around trading electricity have evolved to accommodate and encourage more consumption/generation from assets that can shift when they consume electricity such as batteries, solar and heat pumps etc.

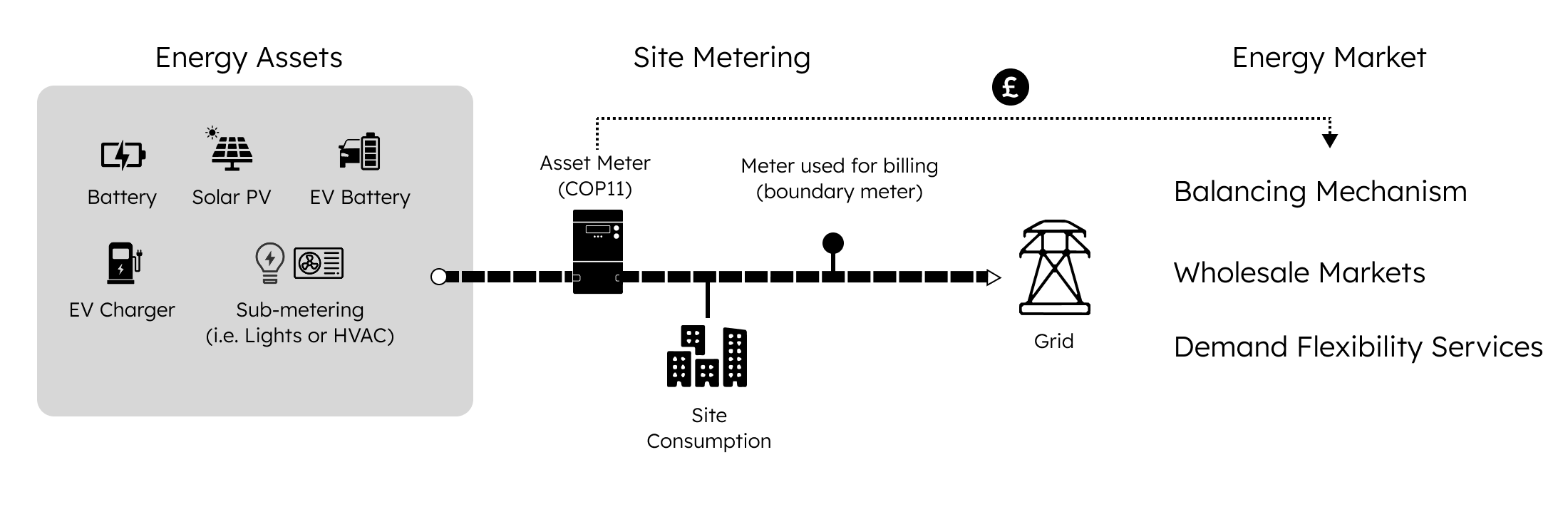

With a CoP11 meter an asset’s consumption/generation can be directly placed in Great Britain’s (GB) markets. Previously all market-traded energy data was measured solely at a site’s boundary meter. Now electricity consumers can extract greater value from their assets’ consumption/generation by placing that energy onto electricity markets.

Today a site with a CoP11 meter can participate like this:

What does participating in the GB electricity market mean?

In GB, consumers typically engage with the retail market by selecting an energy supplier and deciding on a tariff. Beneath that market sits the real machinery of the electricity system: the Balancing Mechanism and the Balancing and Settlement Code (BSC).

The Balancing Mechanism ensures GB’s grid’s supply and demand are balanced in real-time, determining prices to correct any imbalance and sending signals to turn up or down flexible generation/consumption at those prices. The BSC sets the technical standards for metering, the data flows that record half-hourly consumption and generation, and the settlement timetable that ensures every unit of electricity generated or used is correctly accounted and paid for. In effect, the half-hourly settlement under the BSC is the accounting system for the entire electricity market.

Metering is fundamental to this process: while energy Suppliers and Generators can settle the cost of electricity outside wholesale markets, all units of electricity that enter the public electricity grid are governed by the BSC. This ensures Elexon, the company that administers the BSC, can accurately calculate the grid’s balance and operate wholesale markets.

There are several parties registered with Elexon, each with a specific role in how electricity is measured, traded and settled. The type most people know is the electricity supplier, who buys and sells energy on behalf of their customers.

Recent reforms to the BSC have widened participation, allowing much greater use of flexible generation and demand in the Balancing Mechanism and other markets. Energy from assets owned by consumers can now be placed directly in these markets and, crucially, accurately settled under the BSC. Just as a supplier enables a consumer to buy or sell the electricity their boundary meter measures, an asset metering virtual lead party (AMVLP) enables the asset owner to buy or sell the energy their asset meter measures.

Recent changes to the BSC enable assets to participate in GB markets

Three regulatory changes to the BSC have enabled assets to participate:

- P375, effective from June 2022 – qualified meters behind the boundary point can now participate in GB markets.

- CoP11, effective from June 2022 – developed under P375, CoP11 defines the minimum requirements for asset metering systems to be used for GB market participation. Here’s the Glow Guide on CoP11.

- P483, awaiting implementation – allows asset meters to participate in GB markets where the associated boundary meter is not half-hourly settled. As of November 2024, around 95% of boundary meters aren’t settled half-hourly, hugely limiting the assets that can place their energy on GB energy markets.

While these three recent regulations enable assets to profit directly from GB markets, in practice AMVLPs were restricted to Balancing Mechanism participation. An additional regulation opened AMVLPs to the wholesale market:

- P415, effective from November 2024 – enables AMVLPs to participate in GB wholesale markets under a new BSC registered role: virtual trading party (VTP).

Collectively, these regulations enable assets to earn from flexibility across a variety of GB markets.

The core benefit of these changes

Removing existing limitations

Traditional boundary metering limits the asset owner’s ability to participate in GB electricity markets as it requires their electricity supplier to half-hourly settle their consumption/generation. This became only mandatory for larger non-domestic consumers (meter Profile Classes 5-8) in 2017 and half-hour settlement does not mean half-hour reporting. To this day, many engineers must manually read half-hour readings from the meter for previous months/weeks/days at high cost and time delay to any business trying to participate in GB markets.

Despite the government’s push for smart/automated metering which can report half-hourly, 30% of UK homes and small businesses don’t have them. When businesses and homes do have half-hourly reporting meters, data access (particularly for non-domestic) is often fragmented or delayed, leaving both consumers and suppliers without timely visibility of actual energy use.

CoP11 addresses these limitations by introducing a consistent, BSC-approved framework for accurate, asset-level metering data. This benefits suppliers as much as asset owners: it reduces imbalance risk from unobserved behind-the-meter activity, improves forecasting accuracy, and cuts manual data handling costs.

Independence from supplier

Asset metering is independent of your electricity supply contract. With P483 your boundary meter doesn’t need to be settled half-hourly and even if it is, CoP11 ensures the asset can participate in the electricity market independently of the supply contract.

Additional revenue sources

In addition to the import/export contract with the electricity supplier, with CoP11 the asset now has access to multiple markets, explained below.

Enabling a greener future

CoP11 offers the trust required for distributed flexibility to scale, supporting GB’s path to Net Zero because it supports grid stability, reduces the use of fossil fuel peaking plants, enhances renewable energy integration and enables a decentralised energy system.

Smaller distributed flexibility in particular offers unique advantages. They can be discreetly hidden within neighbourhoods, or small brownfield sites, minimising visual impact and further decentralise ene

Which main markets do AMVLPs/VTPs operate in?

Balancing Mechanism

The Balancing Mechanism operates 24/7 and runs auctions for each subsequent half-hour, called a settlement period. 60-90 minutes before a given half-hour an auction opens where AMVLPs can submit bids and offers reflecting the price they’re willing to receive to increase or decrease their aggregated demand. Then, in real-time, the National Energy System Operator (NESO) accepts an AMVLPs bid/offer and, upon acceptance, the AMVLP will change their consumption/generation by trying to adjust a consumer’s asset’s operation.

Elexon then uses the data from the asset meter and the associated boundary meter to calculate the delivered volume.

Over the Counter (OTC) agreements with other BSC parties

VTPs can trade an asset’s energy bilaterally with other BSC registered parties through power purchase agreements or OTC trades outside centralised markets. These trades specify energy volumes, delivery periods and prices. Each party then notifies Elexon through Energy Contract Volume Notifications (ECVNs) or Metered Volume Reallocation Notifications (MVRNs). These notifications feed into settlement to determine each party’s net contractual position versus actual metered volumes.

Short-term physical markets

VTPs can access wholesale electricity markets directly. Unlike the Balancing Mechanism, which trades real-time balancing energy, the wholesale markets allow participants to buy or sell energy ahead of delivery to take advantage of forecast price movements.

Consequently, VTPs trade in deviation volumes which represent the difference between what is forecast to be consumed/generated and what was actually consumed/generated.

VTPs trade across the main short-term markets operated by EPEX SPOT and Nord Pool.

Settlement for these trades is still governed by the Balancing and Settlement Code (BSC), ensuring the traded volumes align with measured delivery from the underlying assets.

These trades hedge expected positions rather than respond to live balancing signals, complementing the reactive role AMVLPs play in the Balancing Mechanism.

DNO Flex

Distribution network operators (DNOs) are the companies that own and manage the local electricity infrastructure connecting an electricity consumer's asset to the grid.

DNO’s operate their own localised energy markets, often paying for available capacity or reducing transmission constraints.

Ancillary Services

The majority of ancillary services are unavailable to VLPs due to the fast response times required and the overhead of aggregating multiple assets. However, with a 30-second response time, firm frequency response (FFR) has offered an opportunity for fast responding assets, such as batteries, to be called upon by AMVLPs.

The list above is not exhaustive and there are many brokers and other smaller or private markets that AMVLPs/VTPs can make use of provided that any trades settled through them involve counterparties who are registered as BSC parties.

How do AMVLP/VTPs participate in electricity markets?

How AMVLPs participate influences how they optimise consumer’s assets. Their optimisation depends on three main trading types: absolute energy, capacity, and deviation volumes.

| Trading Type | Description | Explanation | Markets |

|---|---|---|---|

| Absolute Energy (kW) | Rewards the energy generation or consumption measured by the asset meter. | Markets like the Balancing Mechanism reward absolute energy due to known, time pressured, energy needs that were not forecast by the wholesale market. |

|

| Capacity | AMVLPs are paid for the capacity (total MWs) they commit to make available rather than for continuous energy. | Used to ensure sufficient availability to meet demand or provide system support when needed. |

|

| Deviation Volumes | Deviation volumes are the difference between what a site is forecast to consume/generate versus what was actually consumed/generated. | Wholesale markets operate ahead of time and trade forecasted consumption for fixed time blocks. Absolute energy isn’t used for VLPs because their flexible assets can shift production or consumption between blocks. VLPs therefore earn value by shifting base load to cheaper periods. |

|

CoP11’s role in market transformation

CoP11 represents the shift in how market participation is verified. It creates a standard for any connected asset to become a market participant, supporting:

- Greater system flexibility and resilience.

- Fairer access to additional markets.

- Reliable, granular data for asset reporting.

- Additional revenue sources for asset owners.

In simple terms it's a seal of approval that says: “this device’s energy data can be trusted for market use”.

Glossary

| Term | Definition |

|---|---|

| Asset | Elexon defines an asset broadly, encompassing most electrical components. Elexon’s definition of asset: refers to a plant or apparatus behind the boundary meter comprised within a Secondary Balancing Mechanism Unit. |

| Asset Metering Virtual Lead Parties (AMVLPs) | A BSC registered role to trade the electricity of aggregated assets. |

| Balancing and Settlement Code (BSC) | Sets the technical standards for metering, the data flows that record half-hourly consumption and generation, and the settlement timetable that ensures every unit of electricity generated or used is correctly accounted and paid for. |

| Balancing Mechanism | Ensures GB’s grid’s supply and demand are balanced in real-time, determining prices to correct any imbalance and sending signals to turn up or down flexible generation/consumption at those prices |

| Boundary meter | Measures the flow of electricity (import or export) at the point where the private supply connects to the grid. |

| Code of Practice (CoP) | Requirements and protocols to be met in order to comply with wholesale electricity sector regulation. |

| Deviation Volume | Deviation volumes are the difference between what a site is forecast to consume/generate versus what was actually consumed/generated. |

| Distribution Network Operator (DNO) | A organisation that owns and manages local electricity infrastructure connecting a consumer's asset to the grid. |

| Elexon | Manage the BSC. Compare how much electricity generators said they would produce, and suppliers said they would sell, with the actual metered volumes and works out a price for these differences. Ensure generators and suppliers either pay, or are paid, to settle any differences. Elexon is wholly owned by GB’s National Energy System Operator (NESO). |

| National Energy System Operator (NESO) | An independent, public corporation responsible for planning GB’s electricity and gas networks, operating the electricity system and creating insights and recommendations for the future whole energy system. |

| Physical market | A place to directly buy tangible goods involving the actual delivery of electricity. |

| Settlement period | The 30-minute block used in the GB electricity market for measuring, trading, and settling electricity generation and consumption. |

| Virtual Trading Parties (VTPs) | A BSC registered role to trade deviation volumes of aggregated assets on the wholesale market. |

Ready to Join the Market?

Keep updated on CoP11 Certification or get started with professional-grade metering solutions tailored to your specific requirements.