CoP11 explained

Make money from your energy assets

Download this article (PDF)What is CoP11?

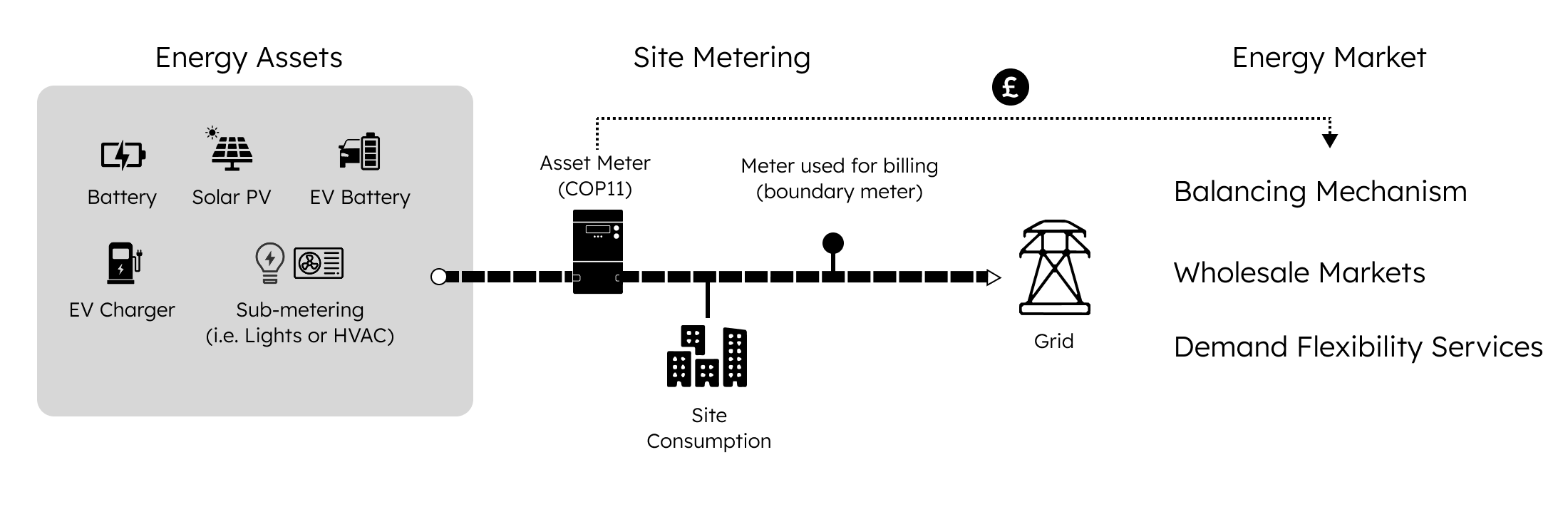

Code of practice 11 (CoP11) is a metering standard to ensure the energy monitored by an asset meter is suitable for Great Britain’s electricity markets. CoP11 compliance declares that the meter’s accuracy, security, interoperability and, most importantly, the reported half-hourly consumption/generation meet GB market standards.

With CoP11 your energy asset (e.g. solar, battery) can now earn revenue from direct access to multiple markets: wholesale, the Balancing Mechanism, Distribution Network Owner (DNO) flexibility, and soon, Capacity Market (refer to our CoP11 and GB Energy Markets ) Guide. Note: CoP11 metering is independent of your import/export energy contract with your electricity supplier.

The ability to accurately measure individual assets' generation/consumption underpins the next stage of GB’s flexibility market; CoP11 builds the trust needed for distributed flexibility to scale.

From energy asset to the market

Why is CoP11 so important?

CoP11 certified meters facilitate market access, revenue opportunity and offer the potential to play a significant role in supporting the UK’s path to Net Zero.

| Market Phase | Who can participate? | |

|---|---|---|

| Before CoP11 | With CoP11 | |

| Eligibility | Only half-hourly settled sites (measured and billed for each 30-minute slot) | Any asset with a CoP11 meter. Independently, if site is half-hourly settled. |

| Access | Limited to boundary-metered sites (no sub-metering) | Any measured asset can access the flexibility markets |

| Revenue | Individual assets cannot earn revenue | Individual assets can generate flexibility income no matter their size |

| Supplier Dependency | Relies on electricity supplier to participate in the market | Operates independently from electricity supply contracts |

How CoP11 works in practice

If you have energy assets (Solar PV, Heat Pumps or Batteries) you just need to install a CoP11 certified meter in front of your asset to participate in the previously mentioned markets.

That’s it! Now your asset’s energy can be placed on UK electricity markets by any qualified Asset Metering Virtual Lead Party (AMVLP). See CoP11 and GB Energy Markets Guide.

Why do you need an AMVLP?

AMVLPs are responsible for overseeing commissioning and market registration for your meter.

Glow Metering is partnered with Axle Energy, a qualified AMVLP that makes this process easy and efficient for asset owners. Other Qualified AMVLPs can be found here.

Why are we explaining CoP11?

Soon, Hildebrand's Glow545-CT meter will be CoP11 compliant — meeting the GB standard that allows asset meter data to be traded on GB electricity markets. With a CoP11-compliant meter you ensure the accuracy and security on your half-hourly reporting that aligns perfectly with market requirements.

Important to note

GB electricity markets operate half-hourly with a minimum bid of 1MW required to participate, but that doesn’t exclude you from the market if your asset is below that threshold. An energy aggregator places your energy flows in the market with others’ assets, taking the pain of optimising and placing your consumption in markets away.

The underlying regulations that allow CoP11 meters to participate in GB markets are:

- P375: qualified meters behind the boundary point can participate in GB markets

- P483 (awaiting implementation): allows asset meters to participate where the associated boundary meter is not half-hourly settled, the case for 95% of boundary meters.

For a full explanation of market participation, read CoP11 and GB Energy Markets.